Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐

| | |

Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

☐

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒

ý |

|

Definitive Proxy Statement |

☐

o |

|

Definitive Additional Materials |

☐

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

Information Services Group, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

Payment of Filing Fee (Check the appropriate box): |

ý☒ |

|

| No fee required. |

o ☐ |

|

| Fee paid previously with preliminary materials. |

☐ | | | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies:

|

| | (2) | | Aggregate number of securities to which transaction applies:

|

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) | | Proposed maximum aggregate value of transaction:

|

| | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | (2) | | Form, Schedule or Registration Statement No.:

|

| | (3) | | Filing Party:

|

| | (4) | | Date Filed:

|

TABLE OF CONTENTS

Information Services Group, Inc.

2187 Atlantic Street

Stamford, Connecticut 06902

TO THE STOCKHOLDERS OF

Information Services Group, Inc.:

You are cordially invited to attend the Annual Meeting of Stockholders of Information Services Group, Inc. (the

"Company"“Company”) on April

30, 2020,27, 2023, at 10:00 a.m. Eastern Time, which will be held at the offices of the Company, 2187 Atlantic Street, Stamford

06902, Connecticut (the

"Annual Meeting"“Annual Meeting”).

Details of business to be conducted at the Annual Meeting are given in the attached Notice of Annual Meeting of Stockholders and Proxy Statement.

We are pleased to take advantage of the U.S. Securities and Exchange Commission rule that allows companies to furnish proxy materials to their stockholders over the internet. As a result, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the

"Notice"“Notice”) instead of a paper copy of this

proxy statementProxy Statement and our Annual Report to Stockholders for the fiscal year ended December 31,

2019.2022. We believe this process allows us to provide our stockholders with the information they need in a timely manner while reducing the environmental impact and lowering costs of printing and distributing our proxy materials. The Notice contains instructions on how to access those documents over the internet. The Notice also contains instructions on how to request a paper copy of our proxy materials, including this

proxy statement,Proxy Statement, our Annual Report to Stockholders for the fiscal year ended December 31,

20192022 and a form of proxy card. Beginning on or about March

20, 2020,15, 2023, this Notice and this Proxy Statement are being distributed and made available to our stockholders.

We hope that you will attend the Annual Meeting.

Your vote is important to us and to our business. We encourage you to vote by telephone, over the internet or, if you requested to receive printed proxy materials, by marking, signing, dating and returning your proxy card so that your shares will be represented and voted at the Annual Meeting, whether or not you plan to attend. If you attend the Annual Meeting, you will, of course, have the right to revoke the proxy and vote your shares in person.

| | | Sincerely yours, |

| | Sincerely yours,

| |

| |

| Michael P. Connors

Chairman and Chief Executive Officer |

TABLE OF CONTENTS

Information Services Group, Inc.

2187 Atlantic Street

Stamford, Connecticut 06902

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held April

30, 202027, 2023

TO THE STOCKHOLDERS OF

Information Services Group, Inc.:

Notice is hereby given that the Annual Meeting of Stockholders of Information Services Group, Inc. (the

"Company"“Company”) will be held at the

Company'sCompany’s offices, 2187 Atlantic Street, Stamford, Connecticut

06902 on April

30, 2020,27, 2023, at 10:00 a.m. Eastern Time, for the following purposes:

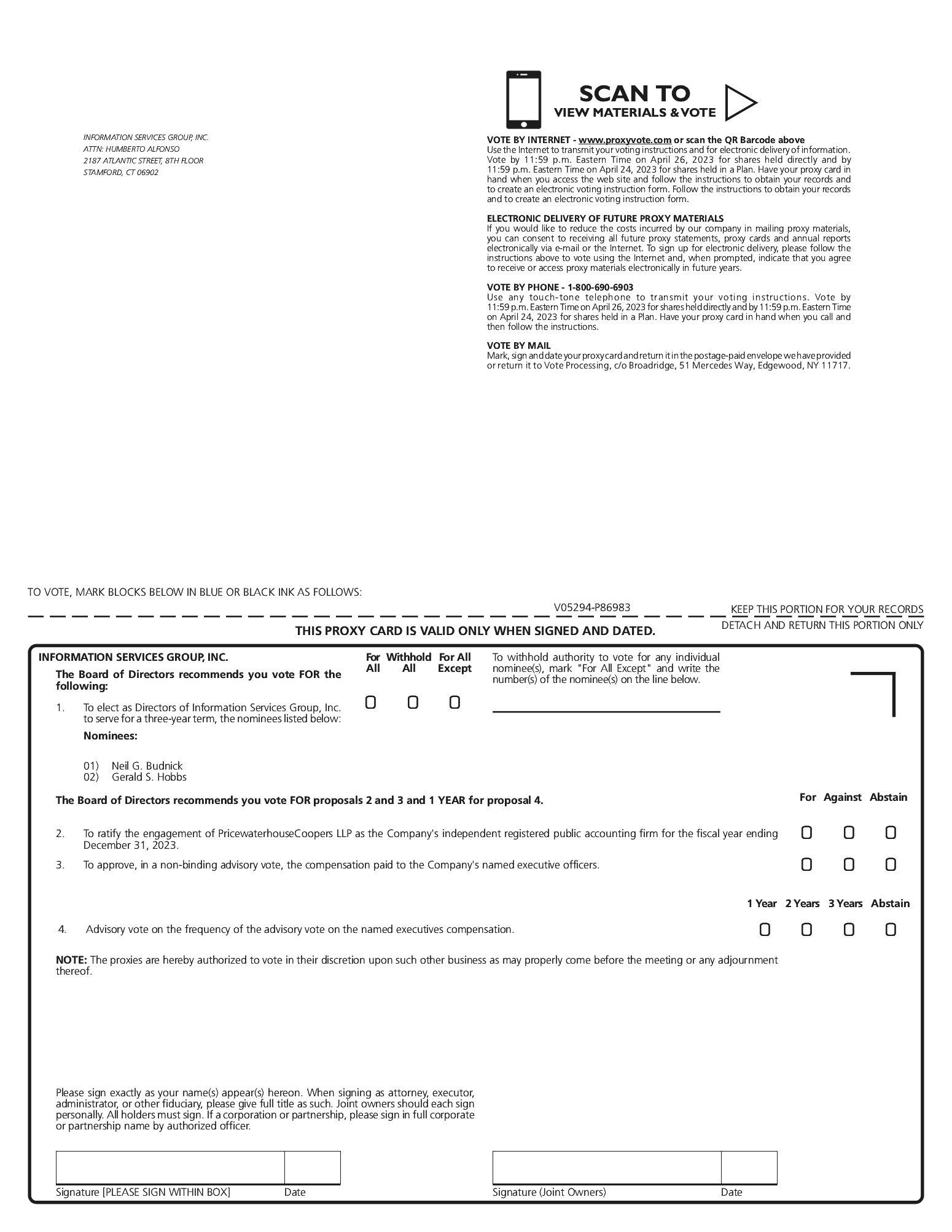

1. To elect two directors to

each serve for a three-year term and until their successors have been elected and qualified.

2. To ratify the engagement of PricewaterhouseCoopers LLP as the

Company'sCompany’s independent registered public accounting firm for the fiscal year ending December 31,

2020.2023.

3. To approve, in a non-binding advisory vote, the compensation paid to our named executive officers as described herein.

4. To

determine, in a non-binding advisory vote, whether a stockholder vote to approve

an amendmentthe compensation paid to

the Company's Amended and Restated 2007 Equity and Incentive Award Plan (the "Plan") primarily to increase the number of shares of common stock available for issuance under the Plan by 5,500,000.our named executive officers should occur every one, two or three years.

5.

To approve an amendment to the Company's Employee Stock Purchase Plan primarily to increase the number of shares of common stock available for issuance under that plan by 1,200,000 shares. 6. To transact such other business as may properly come before the meeting.

Stockholders of record at the close of business on March

4, 20202, 2023 are entitled to notice of, and to vote at, the

meetingAnnual Meeting and any adjournment or postponement thereof.

| | |

| | | By Order of the Board of Directors,

|

| |

| |

| | | Michael P. Connors

Chairman and Chief Executive Officer |

Stamford, Connecticut

IMPORTANT: Your vote is important. Proxy voting permits stockholders unable to attend the Annual Meeting to vote their shares through a proxy.

MostWe understand that most stockholders are unable to attend the Annual Meeting. By appointing a proxy, your shares will be represented and voted in accordance with your instructions. If you submit a proxy, but do not provide specific instructions on how to vote, the proxies will vote your shares as recommended by the Board of Directors. You can change your voting instructions or revoke your proxy at any time prior to the Annual Meeting by following the instructions described in the accompanying proxy statement. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from

Table of Contents

them to vote your shares. If you have any questions regarding how to vote, please contact our proxy solicitor, Innisfree M&A Incorporated, toll-free at (888) 750-5834.(877) 717-3930. (Banks and brokers may call collect at (212) 750-5833.)

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to Be Held on April 30, 2020

The Notice of Annual Meeting of Stockholders, Proxy Statement and 2019 Annual Report to Stockholders are available free of charge athttps://materials.proxyvote.com/45675Y.

Copies of our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, including financial statements and schedules thereto, are also available without charge to stockholders upon written request addressed to: Chief Financial Officer, Information Services Group, Inc., 2187 Atlantic Street, Stamford, Connecticut 06902.

Table of Contents

TABLE OF CONTENTS

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to Be Held on April 27, 2023 |

|

The Notice of Annual Meeting of Stockholders, Proxy Statement and 2022 Annual Report to Stockholders are available free of charge at www.proxyvote.com. |

|

Copies of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, including financial statements and schedules thereto, are also available without charge to stockholders upon written request addressed to: Chief Financial Officer, Information Services Group, Inc., 2187 Atlantic Street, Stamford, Connecticut 06902. |

TABLE OF CONTENTS

TABLE OF CONTENTS

| | Page | |

|---|

Proxy Statement for Annual Meeting of Stockholders | | | | |

Proposal No. 1 Election of Directors | | | | |

| | | | |

Proposal No. 2 Ratification of Engagement of Independent Registered Public Accounting Firm | | | | |

Report of Thethe Audit Committee | | | | |

Proposal No. 3 Non-Binding Advisory Vote on Executive Compensation | | | | |

Proposal No. 4 ApprovalNon-Binding Advisory Vote on the Frequency of the Amendment to the Amended and Restated 2007 Equity and Incentive Award Plan Stockholder Votes on Executive Compensation | | | | |

ManagementProposal No. 5 Approval of the Amendment to the Employee Stock Purchase Plan

| | | | |

| | | | |

| | |

38 | |

Summary Compensation Table | | | | |

Outstanding Equity Awards At 2019at 2022 Fiscal Year-End | | | | |

| | | | |

| | | |

| | | | |

Stockholder Proposals and Nominations | | | | |

Transaction of Other Business | | | | |

TABLE OF CONTENTS

Table of Contents

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

The accompanying proxy is solicited by the Board of Directors of Information Services Group, Inc., a Delaware corporation

("(“ISG,

"” the

"Company," "we," "us,"“Company,” “we,” “us,” and

"our"“our”), for use at its Annual Meeting of Stockholders to be held

at the Company’s offices, 2187 Atlantic Street, Stamford, Connecticut 06902, on April

30, 202027, 2023 at 10:00 a.m. Eastern Time (the

"Annual Meeting"“Annual Meeting”), or any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. This Proxy Statement and the enclosed proxy are being distributed and made available to our stockholders on or about March

20, 2020.15, 2023.

Notice of Internet Availability of Proxy Materials

In accordance with the rules of the Securities and Exchange Commission (the

"SEC"“SEC”), we sent a Notice of Internet Availability of Proxy Materials on or about March

20, 202015, 2023 to our stockholders of record as of the close of business on March

4, 2020.2, 2023. We also provided access to our proxy materials via the internet beginning on that date. If you received a Notice of Internet Availability of Proxy Materials by mail and did not receive, but would like to receive, a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in this

proxy statementProxy Statement or in the Notice of Internet Availability of Proxy Materials.

Record Date, Outstanding Voting Securities

Only stockholders of record as of the close of business on March

4, 20202, 2023 will be entitled to vote at the meeting and any postponement or adjournment thereof. As of March

4, 2020,2, 2023, we had

47,012,71548,408,104 shares of common stock outstanding and expected to be entitled to vote with respect to all matters to be acted upon at the Annual Meeting. Each stockholder of record as of March

4, 20202, 2023 is entitled to one vote for each share of common stock held by such stockholder.

Our Bylaws require that a quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if the holders of a majority of the shares entitled to vote are present in person or by proxy. Shares will be counted towards the quorum only if the stockholder submits a valid proxy (or one is submitted on such

stockholder'sstockholder’s behalf by such

stockholder'sstockholder’s broker, bank or other nominee) or if the stockholder votes in person at the Annual Meeting. Abstentions,

"withhold"“withhold” votes and broker non-votes will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the Annual Meeting or the presiding officer at the Annual Meeting may adjourn the Annual Meeting until a quorum is present.

In accordance with our amended and restated certificate of incorporation and bylaws:

For Proposal No. 1, the nominees receiving a plurality of votes cast will be elected. Proxies cannot be voted for more than two nominees; and

•Proposals Nos. 2, 3

4 and

54 require the affirmative vote of a majority of the votes cast by holders of shares of ISG common stock represented in person or by proxy at the Annual Meeting.

For the election of directors, abstentions,

"withhold votes"“withhold votes” and broker non-votes will have no effect on the outcome of the vote because they are not considered

"votes cast"“votes cast” for voting purposes. For Proposal No. 2, abstentions will have no effect on the outcome of this proposal because they are not considered

"votes cast"“votes cast” for voting purposes. Under

theapplicable rules

of the New York Stock Exchange, member

Table of Contents

brokers who hold shares in street name for their customers that are the beneficial owners of those shares have the authority to only vote on certain "routine"“routine” items in the event that they have not received instructions from beneficial owners. Proposal No. 2 is considered a "routine"“routine” item, and accordingly, brokers and other nominees will have discretionary authority to vote on Proposal No. 2, such that we expect there to be no broker non-votes on that Proposal. For Proposals Nos.No. 3 4 and 5,No. 4, abstentions and broker non-votes will have no effect on the outcome of this proposalsuch proposals because they are not considered "votes cast"“votes cast” for voting purposes.

TABLE OF CONTENTS

The Board of Directors of the Company recommends a vote:

“FOR” each of the nominees named in Proposal No. 1;

•"FOR"“FOR” the engagement of PricewaterhouseCoopers LLP as the Company'sCompany’s independent public accounting firm for the fiscal year ending December 31, 2020;

•"FOR"2023;“FOR” approval of the compensation paid to our Named Executive Officers;

•"FOR" approval of an amendment and“One Year” with respect to

how frequently a stockholder vote to approve, in a non-binding vote, the

Company's Amended and Restated 2007 Equity and Incentive Award Plan (the "Plan") primarily to increase the number of shares of common stock availablecompensation paid for

issuance under the Plan; and

•"FOR" approval of an amendment to the Company's Employee Stock Purchase Plan primarily to increase the number of shares of common stock available for issuance under that plan.our Named Executive Officers should occur.

The proxy accompanying this

proxy statementProxy Statement is solicited on behalf of our Board of Directors

(the “Board”) for use at the Annual Meeting and any postponements or adjournments of the Annual Meeting, and the expenses of solicitation of proxies will be borne by the Company. The solicitation will be made primarily by mail or via the internet, but our officers and regular employees may also solicit proxies by telephone, facsimile or in person.

No additional compensation will be paid to our officers or regular employees for such services. We also have retained Innisfree M&A Incorporated

("Innisfree"(“Innisfree”) to assist in soliciting proxies. ISG expects to pay Innisfree approximately

$10,000$12,500.00 plus expenses in connection with its solicitation of proxies.

If on March

4, 20202, 2023 your shares are registered directly in your name with the

Company'sCompany’s registrar and transfer agent, Continental Stock Transfer & Trust

("Continental"(“Continental”), you are considered a stockholder of record with respect to those shares, and the Notice was sent to you directly by the Company. As the stockholder of record, you have the right to grant your voting proxy directly to the Company or to vote in person at the Annual Meeting.

If on March

4, 20202, 2023 your shares are held in a brokerage account with a bank, broker-dealer, trust or similar organization, you are considered the

"beneficial owner"“beneficial owner” of those shares held in

"street name"“street name,” and the Notice was forwarded to you by that organization. The organization that holds your shares is considered the stockholder of record for purposes of voting at the Annual Meeting. Because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from the organization that holds your shares giving you the right to vote your shares at the Annual Meeting. As the beneficial owner, you have the right to direct your broker or other intermediary how to vote your shares, and you are also invited to attend the Annual Meeting.

Your vote is very important to us

and we hope that you will attend the Annual Meeting. However, whether or not you plan to attend the Annual

Meeting, pleaseMeeting. Please vote by proxy in accordance with the

Table of Contents

instructions on your proxy card, voting instruction form (from your broker or other intermediary) or the instructions that you received through electronic mail. There are three convenient ways of submitting your vote:

By Telephone or Internet—All stockholders of record can vote by touchtone telephone from the U.S. using the toll-free telephone number on the proxy card, or over the internet using the procedures and instructions described on the proxy card. Beneficial owners may vote by telephone or internet if their broker or other intermediary makes those methods available, in which case the broker or other intermediary will enclose the instructions with the proxy materials. The telephone and internet voting procedures are designed to authenticate stockholders'stockholders’ identities, to allow stockholders to vote their shares and to confirm that their instructions have been recorded properly.

•In Person—All stockholders of record may vote in person at the Annual Meeting. Beneficial owners may vote in person at the Annual Meeting if their broker or other intermediary has furnished a legal proxy. If you are a beneficial owner and would like to vote your shares by proxy,at the Annual Meeting, you will need to ask your broker or other intermediary to furnish you with a legal proxy. You will need to bring the legal proxy with you to the Annual Meeting and hand it in with a signed ballot that will be provided to you at the Annual Meeting. You will not be able to vote your shares without a legal proxy.

TABLE OF CONTENTS

•By Written Proxy—All stockholders of record can vote by written proxy card, if they have requested to receive a paper copy of our proxy materials. If you are a beneficial holder and you requested to receive printed proxy materials, you will receive a written proxy card and a voting instruction form from your broker or other intermediary.All valid proxies received before the meeting will be exercised. All shares represented by a proxy will be voted, and where a proxy specifies a

stockholder'sstockholder’s choice with respect to any matter to be acted upon, the shares will be voted in accordance with that specification.

If no choice is indicated on the proxy, the shares will be voted "For"“For” the election of the nominees named in this Proxy Statement, and "For"“For” proposals two and three.three and “One Year” for proposal four. A stockholder whose shares are registered in such stockholder'sstockholder’s own name has the power to revoke his or her proxy at any time before it is exercised by (i)delivering to the Chief Financial Officer of the Company a written instrument revoking the proxy, (ii) voting again over the internet or by telephone (only your latest internet or telephone proxy submitted prior to the Annual Meeting will be counted) or, if you requested and received written proxy materials, by signing and returning a new proxy card with a later date or a duly executed proxy with a later date or (iii) by attending the meetingAnnual Meeting and voting in person. If you hold shares in street name, through a bank, broker or other nominee, please contact the bank, broker or other nominee to revoke your proxy.If you have any questions regarding how to vote, please contact our proxy solicitor, Innisfree M&A Incorporated, toll-free at

(888) 750-5834.(877) 717-3930. (Banks and brokers may call collect at (212) 750-5833.)

If you are a beneficial owner, your bank or broker may deliver a single proxy statement, along with individual proxy cards, or individual Notices to any household at which two or more stockholders reside unless contrary instructions have been received from you. This procedure, referred to as householding, reduces the volume of duplicate materials stockholders receive and reduces mailing expenses. Stockholders may revoke their consent to future householding mailings or enroll in householding mailings by contacting the Company, either by calling (203) 517-3100 or by forwarding a written request addressed to Chief Financial Officer, Information Services Group, Inc., 2187 Atlantic Street, Stamford, Connecticut 06902.06902 or Broadridge at 51 Mercedes Way, Edgewood, NY 11717. Alternatively, if you wish to receive a separate set of proxy materials for this year'syear’s Annual Meeting, we will deliver them promptly upon request to Chief Financial Officer, Information Services Group, Inc., 2187 Atlantic Street, Stamford, Connecticut 06902.06902 or by calling (203) 517-3100.

Table of ContentsTABLE OF CONTENTS

Our amended and restated certificate of incorporation provides that the Board of Directors of the Company is divided into three classes with one class of directors being elected each year and each class serving a three-year term. Neil G. Budnick and Gerald S. Hobbs constitute a class with a term that expires at this

annual meetingAnnual Meeting (the

"Class“Class I

Directors"Directors”)

;. Bruce N. Pfau, Kalpana Raina and Donald C. Waite III constitute a class with a term that expires at the Annual Meeting in

20212024 (the

"Class“Class II

Directors"Directors”)

; and Michael P. Connors and Christine Putur constitute a class

with a term that expires at the Annual Meeting in

20222025 (the

"Class“Class III

Directors"Directors”).

The Board of Directors has considered and nominated the following nominees to be Class I Directors for a three-year term expiring in

2023:2026: Neil G. Budnick and Gerald S. Hobbs. Action will be taken at the Annual Meeting for the election of these Class I Directors. Set forth below is information regarding the nominees to the Board of Directors for election as directors.

It is intended that the proxies delivered pursuant to this solicitation will be voted in favor of the election of Neil G. Budnick and Gerald S. Hobbs unless otherwise directed by the person furnishing a valid proxy. The nominees have agreed to be named in this Proxy Statement and to serve if elected. If the nominees decline to serve or become unavailable for any reason, or if a vacancy occurs before the election (although we know of no reason to anticipate that this will occur), the proxies may be voted for such substitute nominee(s) as we may designate.

If a quorum is present and voting, the nominees receiving a plurality of votes cast will be elected. Proxies cannot be voted for more than two nominees. Abstentions,

"withhold votes"“withhold votes” and broker non-votes will have no effect on the outcome of the vote because they are not considered

"votes cast"“votes cast” for voting purposes.

The nominees to the Board of Directors to serve until the third succeeding annual meeting of stockholders after their election and until their successors have been elected and qualified are:

Neil G. Budnick | | | 69 | | | 2011 |

Gerald S. Hobbs | | | 81 | | | 2008 |

| | | | | | | |

Name | | Age | | Director Since | |

|---|

Neil G. Budnick | | | 66 | | | 2011 | |

Gerald S. Hobbs | | | 78 | | | 2008 | |

The principal occupations and qualifications of the nominees for director are as follows. There are no family relationships among any of our directors or executive officers.

Neil G. Budnick

has served as our Director since June 2011. Mr. Budnick is currently the Managing Director at Channel Rock Partners, a management consulting firm that provides business strategy and opportunity analysis, operations improvement and risk management for corporations. Until April 2007, Mr. Budnick was President of MBIA Insurance Corporation (“MBIA”), a major financial services company. During his 23 years at MBIA, Mr. Budnick held increasingly important positions, including: Vice Chairman; Chief Financial Officer; President, Public and Corporate Finance Division; and Senior Vice President, Head of Municipal and Structure Finance. Earlier in his career, Mr. Budnick was also Vice President of the Public Finance Department of Standard & Poor'sPoor’s Corporation. He was a Board Member and Chair of the Audit Committee of RHR International, a management firm that specializes in executive development until December 2018. Following an appointment by the Governor of Connecticut in 2012, he served from 2012-2013 as Chairman of the Investment Advisory Council (IAC), the state body responsible for working with the State Treasurer in overseeing the investments of the Connecticut Retirement Plans and Trust Funds. Mr. Budnick holds a B.A. in Political Science from Boston College and an M.P.A. in Public Administration from the University of Colorado.

Gerald S. Hobbs

has served as our Director since January 2008. Mr. Hobbs is an operating partner at BV Investments, LLC.LLC, a middle-market private equity firm focused on the tech-enabled business services, software and IT services sectors. Previously, Mr. Hobbs was the Chairman and CEO of VNU, Inc., now The

Table of Contents

Nielsen Company,Holdings plc, and Vice-Chairman of the Executive Board of VNU N.V. until his retirement in April 2003. Mr. Hobbs has served as Chairman, and Director of the American Business Media, BPA International and the Advertising Council, Inc. He retired from The Nielsen Company and BNA, Inc. boards of directors. He was a member of the Audit Committee at both companies.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR"“FOR” EACH OF

THE NOMINEES NAMED ABOVE

TABLE OF CONTENTS

Responsibilities of the Board of Directors

Our Board of Directors directs the management of our business and affairs, as provided by Delaware law, and conducts its business through meetings of the Board of Directors and three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. In addition, from time to time, special committees may be established under the direction of the Board of Directors when necessary to address specific issues.

The Board of Directors

has determined that combining the CEO and Chairman positions, coupled with a Lead Independent Director position, strengthens the

Company'sCompany’s governance structure and is the appropriate leadership model for the Company at this time. The Board of Directors believes that

"one-size"“one-size” does not fit all, and the decision of whether to combine or separate the positions of CEO and Chairman will vary from company to company, depend upon a

company'scompany’s particular circumstances at a given point in time and may change from time to time. Accordingly, the Board of Directors carefully considers from time to time whether the CEO and Chairman positions should be combined based on what the Board believes is best for the Company and its stockholders.

Board structures vary greatly among U.S. public corporations. The Board of Directors does not believe that any one leadership structure is more effective at creating long-term stockholder value. The Board of Directors believes that an effective leadership structure could be achieved either by combining or separating the CEO and Chairman positions so long as the structure encourages the free and open dialogue of competing views and provides for strong checks and balances. Specifically, an effective governance structure must balance the powers of the CEO and the independent directors and ensure that the independent directors are fully informed, able to discuss and debate the issues that they deem important and able to provide effective oversight of management.

Since March 2014, Mr. Gerald S. Hobbs has served as the Lead Independent Director. In addition to presiding at executive sessions of the independent directors, the responsibilities of the Lead Independent Director also include:

leading the Board'sBoard’s processes for selecting and evaluating the Chief Executive OfficerCEO and Chairman;

•presiding at all meetings of the Board at which the Chairman is not present;

•present:calling additional meetings of the independent directors as appropriate;

•assisting in scheduling Board meetings;

•presiding at all executive sessions of the independent directors of the Board;

•providing the Board of Directors with input as to the preparation of Board meeting agendas;

•specifically requesting the inclusion of certain materials for Board meetings;

•recommending, as appropriate, that the Board of Directors retain consultants who will report directly to the Board of Directors; and

•acting as a liaison between the independent directors and the Chairman on sensitive issues.

The Board of Directors believes that the responsibilities delegated to the Lead Independent Director are substantially similar to many of the functions typically fulfilled by a board chairman. The Board of Directors believes that its Lead Independent Director position balances the need for effective and independent oversight of management with the need for strong, unified leadership.

Table of Contents

The Board of Directors believes that this structure is in the best interests of the Company at this time as it will allow for a balance of power between the CEO and the independent directors and will provide an environment in which its independent directors are fully informed, have significant input into the content of Board meeting agendas and are able to provide objective and thoughtful oversight of management.

TABLE OF CONTENTS

The Board of Directors seeks to ensure that the Board is composed of members whose particular experience, qualifications, attributes and skills, when taken together, will allow the Board to satisfy its oversight responsibilities effectively. In that regard, the Nominating and Corporate Governance Committee is responsible for recommending candidates for all directorships to be filled by the Board or by the stockholders at an annual or special meeting. In identifying candidates for membership on the Board of Directors, the Nominating and Corporate Governance Committee takes into account (1) minimum individual qualifications, such as strength of character, mature judgment, industry knowledge or experience and an ability to work collegially with the other members of the Board of Directors and (2) all other factors it considers appropriate. In addition, although the Board does not have a policy with regard to the consideration of diversity in identifying director nominees, among the many factors that the Nominating and Corporate Governance Committee carefully considers are the benefits to the Company of diversity, including gender and racial diversity, in board composition.

After conducting an initial evaluation of a candidate, the Nominating and Corporate Governance Committee will interview that candidate if it believes the candidate might be suitable to be a director and may also ask the candidate to meet with other directors and management. If the Nominating and Corporate Governance Committee believes a candidate would be a valuable addition to the Board of Directors, it will recommend to the full Board of Directors that

candidate'scandidate’s election.

When considering whether the

Board'sBoard’s directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively in light of the

Company'sCompany’s business and structure, the Board focused primarily on the information discussed in each of the Board

members'members’ or

nominees'nominees’ biographical information set forth on pages

36-37.18-19. In particular, with

regardsregard to Mr. Connors, the Board considered his extensive knowledge of the

Company'sCompany’s business and his position as

Chief Executive OfficerCEO of the Company with the responsibility for the day-to-day oversight of the

Company'sCompany’s business operations. With

regardsregard to Messrs. Budnick, Hobbs, Pfau and Waite and Mses. Putur and Raina, the Board considered their significant experience, expertise and background with regard to business, accounting and financial matters. With

regardsregard to Mr. Budnick, the Board of Directors considered his extensive experience as Managing Director at Channel Rock Partners, a management consulting firm, and as Vice Chairman and Chief Financial Officer of MBIA Insurance Corporation, a major financial services Company. With

regardsregard to Mr. Hobbs, the Board of Directors considered his extensive experience as the Chairman and CEO of various information and media companies, including VNU, Inc. With

regardsregard to Mr. Pfau, the Board considered his experience as a long-term senior executive with KPMG. With

regardsregard to Ms. Putur, the Board of Directors considered her extensive experience in information technology obtained at global corporations in the high tech, retail and fashion sectors, including in her

current role as

Chief Information OfficerExecutive Vice President, Technology and Operations of Recreational Equipment, Inc. (REI)

. from which she recently retired. With

regardsregard to Ms. Raina, the Board of Directors considered her experience as a senior executive with The Bank of New York and her prior service on the Audit Committee of John Wiley & Son. With

regardsregard to Mr. Waite, the Board considered his extensive experience in management consulting as a Managing Director with McKinsey & Company and his service as one of three members of

McKinsey'sMcKinsey’s Office of the Managing Director. In addition, in connection with the nomination of

Mr.Messrs. Budnick and

Mr. Hobbs for election as directors at this Annual Meeting, the Board considered their valuable contributions to the

Company'sCompany’s success during their years of Board service.

Table of Contents

Director Independence

Our Board of Directors currently has seven directors. The Board of Directors has affirmatively determined that all of the directors, other than Mr. Connors, including those who serve on the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee are

"independent"“independent” for purposes of The Nasdaq Stock Market LLC

("Nasdaq"(“Nasdaq”) listing standards and federal securities laws. In the course of the Board of

Directors'Directors’ determination regarding the independence of each non-management director, it considered any transactions, relationships and arrangements as required by the applicable Nasdaq rules and the rules and regulations of the

Securities and Exchange Commission (the "SEC").SEC.

Our independent directors hold regularly scheduled meetings at which only independent directors are present.

TABLE OF CONTENTS

Directors are expected to attend Board meetings,

and meetings of the committees on which they serve and to spend the time needed, and meet as frequently as necessary, in order to properly discharge their responsibilities. The Board of Directors held five meetings during

2019.2022. Each of the standing committees of the Board of Directors held the number of meetings indicated in the table below. Each of our directors serving during

20192022 attended 100% of the total number of meetings of the Board of Directors and all of the committees of the Board of Directors on which such director served during that period.

This Annual Meeting will be our

twelfthfifteenth annual stockholder meeting.

ISG'sISG’s policy is to invite each director to attend the

Company'sCompany’s annual meeting of stockholders but does not require attendance by all directors. ISG periodically monitors and reassesses this policy to ensure the Board remains open and available for stockholder communications.

Committees of the Board of Directors

The Audit, Compensation, and Nominating and Corporate Governance Committees each operate under a written charter adopted by the Board of Directors, and each committee of the Board of Directors reviews and assesses the adequacy of its charter on at least an annual basis. Copies of these charters are available on our website (

www.isg-one.comwww.isg-one.com).The following table sets forth the three standing committees of the Board of Directors, the members of each committee during the last fiscal year and the number of meetings held by each committee during the last fiscal year:

Name of Director | | | | | Audit | | | | | Compensation | | | | | Nominating and

Corporate Governance |

|---|

Michael P. Connors

| | — | — | — | | — | | | — |

Neil G. Budnick

| | Chairman | Chairman | Member | | Member | | | Member |

Gerald S. Hobbs

| | Member | Member | Chairman | | Chairman | | | Member |

Bruce N. Pfau

| | Member | Member | Member | | Member | | | Member |

Christine Putur

| | Member | Member | Member | | Member | | | Member |

Kalpana Raina

| | Member | Member | Member | | Member | | | Member |

Donald C. Waite III

| | Member | Member | Member | | Member | | | Chairman |

| | | 4 Meetings | | 3 | 4 Meetings | | 1 Meeting | 2 Meetings |

Table of Contents

Audit Committee

Our Audit Committee currently consists of Mr. Budnick, as Chairman, Mr. Hobbs, Mr. Pfau, Ms. Putur, Ms. Raina and Mr. Waite. The Audit Committee is responsible for, among other things:

selecting, appointing, compensating, retaining and terminating our independent registered public accounting firm;

•overseeing the auditing work of any independent registered public accounting firm employed by us, including the resolution of any disagreement between management and the independent registered public accounting firm regarding financial reporting, for the purpose of preparing or issuing an audit report or performing other audit, review or attestattestation services;

•pre-approving audit, audit related,audit-related, tax and other services to be performed by the independent registered public accounting firm and related fees;

•meeting with our independent registered public accounting firm to review the proposed scope of the annual audit of our financial statements and to discuss such other matters that it deems appropriate;

•reviewing the findings of the independent registered public accounting firm with respect to the annual audit;

•meeting to review and discuss with management and the independent registered public accounting firm our periodic financial reports prior to our filing them with the SEC and reporting annually to the Board of Directors with respect to such matters;

TABLE OF CONTENTS

reviewing with our financial and accounting management, the independent registered public accounting firm and internal auditor the adequacy and effectiveness of our internal control over financial reporting, financial reporting process and disclosure controls and procedures; and

•reviewing the internal audit function.

In accordance with applicable federal securities laws and the rules of Nasdaq, we have adopted an Audit Committee charter that incorporates these duties and responsibilities.

The Audit Committee is, and will at all times be, composed exclusively of

"independent“independent directors,

"” as determined in accordance with

Nasdaq'sNasdaq’s independence standards, who are able to read and understand fundamental financial statements. In addition, pursuant to the rules of Nasdaq, ISG must have at least one member of the Audit Committee who has past employment experience in finance or accounting, requisite professional certification in accounting or any other comparable experience or background that results in the

individual'sindividual’s financial sophistication. The Board of Directors has determined that each of the Audit Committee members satisfies

Nasdaq'sNasdaq’s definition of financial sophistication and that Mr. Budnick, Mr. Pfau, Mr. Hobbs, Ms. Raina and Mr. Waite each qualify as an

"audit“audit committee financial expert,

"” as defined under the rules and regulations of the SEC.

Additional information regarding the Audit Committee is set forth in the Report of the Audit Committee immediately following Proposal No. 2.

The Compensation Committee currently consists of Mr. Hobbs, as Chairman, Mr. Budnick, Mr. Pfau, Ms. Putur, Ms. Raina and Mr. Waite. The Compensation Committee is responsible for overseeing the compensation and employee benefit plans and practices of the Company, including administering the Amended and Restated 2007 Equity and Incentive Award Plan

(the “Plan”) and the Amended

Table of Contents

and Restated 2007 Employee Stock Purchase Plan. The Compensation Committee is also responsible for, among other things:

reviewing and approving corporate goals and objectives relevant to Chief Executive Officer compensation;

•reviewing with the Chief Executive Officer the performance and compensation of all other executive officers;

•discussing the results of the stockholder advisory vote on the compensation paid to our named executive officers;

•retaining or terminating, as needed, and approving the fees and any other retention terms for, compensation and benefits consultants and other outside consultants or advisors to provide independent advice to the Compensation Committee;

•evaluating on at least an annual basis whether any work provided by a consultant retained by the Compensation Committee raises any conflict of interest; and

•reviewing and establishing policies concerning any management perquisite and similar benefits.

For more information on the Compensation

Committee'sCommittee’s role in determining executive compensation, see

"Executive Compensation"“Executive Compensation” beginning on page

38.20.

In accordance with applicable federal securities laws and the rules of Nasdaq, ISG has adopted a Compensation Committee charter that delineates these duties and responsibilities.

The Board of Directors has determined that all of the members of the Compensation Committee meet the independence requirements mandated by Nasdaq, the rules of the SEC and the Internal Revenue Service, in each case as they are applicable to serving on the Compensation Committee.

The Compensation Committee has retained Pay Governance LLC (“Pay Governance”) to advise it in connection with fulfilling its responsibilities with respect to the Company'sCompany’s executive and Board of Directors compensation programs.

For a discussion of the nature and scope of Pay Governance'sGovernance’s assignment, and the material elements of the instructions or directions given to Pay Governance with respect to the performance of theirits duties under the

TABLE OF CONTENTS

engagement, please see

"Use“Use of Third Party

Advisors"Advisors” beginning on page

38.20. Pay Governance maintains no other direct or indirect business relationships with the Company.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee currently consists of Mr. Waite,

as Chairman, Mr. Budnick, Mr. Hobbs, Mr. Pfau, Ms. Putur and Ms. Raina.

During the last fiscal year and until March 7, 2023, Mr. Waite served as Chairman of the Nominating and Corporate Governance Committee. The Board of Directors appointed Ms. Putur as the new Chairman of the Nominating and Corporate Governance effective March 7, 2023. The Nominating and Corporate Governance Committee is responsible for, among other things:

developing, recommending and monitoring corporate governance guidelines for ISG and the Board of Directors;

•identifying and reviewing the qualifications of candidates for Board membership;

•recommending to the Board of Directors candidates to fill vacancies on the Board which occur between annual meetings of stockholders or for election at annual meetings;

•recommending to the Board of Directors criteria regarding the composition of the Board, the total size of the Board and the proportion of employee and non-employee directors;

•recommending to the Board of Directors committee memberships and chairpersons; and

Table of Contents

•- consulting with the Board of Directors annually regarding the independence of each member of the Board.

In accordance with applicable federal securities laws and the rules of Nasdaq, ISG has adopted a Nominating and Corporate Governance Committee charter that delineates these duties and responsibilities.

The Board of Directors has determined that all of the members of the Nominating and Corporate Governance Committee meet the independence requirements mandated by Nasdaq, the rules of the SEC, in each case as they are applicable to serving on the Nominating and Corporate Governance Committee, and our standards of independence.

The Nominating and Corporate Governance Committee will consider candidates for nomination as a director recommended by stockholders, directors, officers, third party search firms and other sources. The Board and the Nominating and Corporate Governance Committee are committed to identifying and engaging a diverse field of director candidates when considering Board composition. In identifying candidates for membership on the Board of Directors, the Nominating and Corporate Governance Committee takes into account,evaluate all candidates equally across all relevant factors, including, without limitation, factors such as judgment, skill, diversity, character, integrity, collegiality, willingness to act upon and be accountable for majority Board decisions, experience (particularly with businesses and other organizations of comparable size and within similar or related industries) and how that experience interplays with that of the other Board members, independence from management and the ability of the candidate to attend Board and Committee meetings regularly and to devote an appropriate amount of time and effort in preparation for those meetings. In assessing stockholder recommendations, the Nominating and Corporate Governance Committee will consider the same criteria utilized for other candidates but will also consider whether the candidate can serve the best interests of all stockholders of the Company and not be beholden to the sponsoring person or group. A stockholder must provide notice to the Chief Financial Officer that must include the name, address and number of shares owned by the stockholder making such recommendation; the name, age, business address, residence address and principal occupation of the nominee; and the number of shares beneficially owned by the nominee. It must also include the information that would be required to be disclosed in the solicitation of proxies for election of directors under the federal securities laws. You must submit the nominee'snominee’s consent to be elected and to serve. ISG may require any nominee to furnish any other information, within reason, that may be needed to determine the eligibility of the nominee. The notice must be delivered to the Chief Financial Officer, who will forward the notice to the Nominating and Corporate Governance Committee for consideration. Ultimately, the Nominating and Corporate Governance Committee will nominate those individuals who it believes will, in conjunction with other members of the Board, best collectively serve the long-term interests of the Company'sCompany’s stockholders.

TABLE OF CONTENTS

Oversight of Risk Management

On behalf of the Board of Directors, the Audit Committee is responsible for oversight of the

Company'sCompany’s risk management policies and procedures. The Company is exposed to a number of risks including financial risks, operational risks,

and risks relating to regulatory and legal

compliance.compliance and cybersecurity risk. The Audit Committee discusses with management the

Company'sCompany’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the guidelines and policies to govern the process by which risk assessment and risk management are undertaken. The

Company'sCompany’s Chief Financial Officer is responsible for the

Company'sCompany’s risk management function and regularly works closely with the

Company'sCompany’s senior executives to identify risks material to the Company. The Chief Financial Officer reports regularly to the Chief Executive Officer and the

Company'sCompany’s Audit Committee regarding the

Company'sCompany’s risk management policies and procedures. In that regard, the

Company'sCompany’s Chief Financial Officer meets with the Audit Committee at least four times a year to discuss the risks facing the Company, highlighting any new risks that may have arisen since they last met. The Audit Committee also reports to the Board on a regular basis to apprise the Board of

theirits discussions with the Chief Financial Officer regarding the

Company'sCompany’s risk management efforts.

Table In addition, the Board’s other committees, which meet regularly and report back to the Board, play a significant role in carrying out the Board’s risk oversight function. Company management also plays an important role in connection with risk management through the implementation and evaluation of Contents

effective internal controls and other internal processes.

We have adopted a code of ethics and business conduct applicable to our directors, officers and employees in accordance with applicable federal securities laws and the rules of Nasdaq. You may obtain a copy of

ISG'sISG’s code of ethics and business conduct, free of charge, by contacting our Chief Financial Officer. You can also find a link to the code on our website (

https://ir.isg-one.com/corporate-overview/documentswww.isg-one.com). ISG intends to disclose any amendments to, or waivers from, a required provision of its code of ethics and business conduct on its website (www.isg-one.comwww.isg-one.com).Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines to assist the Board and its committees in the exercise of their responsibilities. The Corporate Governance Guidelines, which are available on our website (

www.isg-one.comwww.isg-one.com), set forth guiding principles and provide a flexible framework for the governance of the Company. The Corporate Governance Guidelines address, among other things, Board functions and responsibilities, management succession, Board membership and independence, Board meetings and Board committees, access to management, employees and outside advisors, director orientation and continuing education. The Nominating and Corporate Governance Committee regularly reviews and provides recommendations to the Board on the Corporate Governance Guidelines, and the full Board approves changes as it deems appropriate. You can find a link to the Corporate Governance Guidelines on our website (https://ir.isg-one.com/corporate-overview/documents).

Certain Relationships and Transactions with Related Parties

The Board has adopted the Policy and Procedures with respectRespect to Related Party Transactions (the "Policy"“Policy”) wherebyunder which all transactions required to be reported pursuant to Item 404 of Regulation S-K are reviewed and approved. The Policy calls for the Nominating and Corporate Governance Committee of our Board of Directors (the "Governance Committee"“Governance Committee”), or the Chair of the Governance Committee in exigent circumstances (who will possess delegated authority to act between Governance Committee meetings), to review each related party transaction (as defined below) and determine whether to approve thatsuch transaction. Any Governance Committee member who has any interest (actual or perceived) will not be involved in the consideration of the Governance Committee. In determining whether a related party transaction will be approved, the Governance Committee or Chair of the Governance Committee, as applicable in accordance with the Policy, will consider a multitude of factors, including (a) the benefits to the Company; (b) the impact on a director'sdirector’s independence in the event the related party is a director, an immediate family member of a director or an entity in which a director is a partner, shareholder or executive officer; (c) the availability of other sources for comparable products or services; (d) the terms of the transaction; and (e) the terms available to unrelated third parties or to employees generally.

TABLE OF CONTENTS

Notwithstanding the Policy, all compensation-related matters involving related parties must be approved by the Compensation Committee of the Board of Directors or recommended by the Compensation Committee to the Board of Directors for its approval.

For purposes of the Policy, a "related“related party transaction"transaction” is, subject to certain limited exceptions, any transaction in which we are a participant and the amount involved exceeds $120,000, and the related party (defined below) had, has or will have a direct or indirect material interest in the transaction. "Related party"“Related party” includes (a) any person who is or was (at any time during the last fiscal year) an executive officer, director or nominee for election as a director; (b) any person or group who is a beneficial owner of more than 5% of our voting securities; or (c) any immediate family member of a person described in clauses (a), (b) or (c) of this sentence. A related party may have an indirect material interest through an entity in which he or she is employed or is an executive officer, or partner or is in a similar position, or in which such person, together with all other related parties, has in the aggregate 10% or greater equity interest.

Table of Contents

During 20192022 and 2018,2021, we did not enter into any transactions with related parties that required review, approval or ratification pursuant to the Policy.

Stockholder Communications with Directors

Stockholders may communicate with any and all members of our Board of Directors by transmitting correspondence by mail or facsimile addressed to one or more directors by name (or to the Chairman, for a communication addressed to the entire Board of Directors) at the following address and fax number:

Name of the Director(s)

c/o Chief Financial Officer

Information Services Group, Inc.

2187 Atlantic Street

Stamford, Connecticut 06902

Communications from our stockholders to one or more directors will be collected and organized by our Chief Financial Officer under procedures approved by our independent directors. The Chief Financial Officer will forward all communications to the Chairman of the Board of Directors or to the identified director(s) as soon as practicable, although communications that are abusive, in bad taste or that present safety or security concerns may be handled differently. If multiple communications are received on a similar topic, the Chief Financial Officer may, in his

or her discretion, forward only representative correspondence.

The Chairman of the Board of Directors will determine whether any communication addressed to the entire Board of Directors should be properly addressed by the entire Board of Directors or a committee thereof. If a communication is sent to the Board of Directors or a committee, the Chairman of the Board or the Chairman of that committee, as the case may be, will determine whether a response to the communication is warranted. If a response to the communication is warranted, the content and method of the response will be coordinated with our Chief Financial Officer.

TABLE OF CONTENTS

RATIFICATION OF ENGAGEMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

On March

10, 2020,7, 2023, the Audit Committee and the Board of Directors engaged PricewaterhouseCoopers LLP to continue in its capacity as independent registered public accounting firm for the fiscal year ending December 31,

2020.2023. Stockholders will be asked at the Annual Meeting to ratify the engagement of PricewaterhouseCoopers LLP as

itsthe Company’s independent registered public accounting firm for the fiscal year ending December 31,

2020.2023.

Although the engagement of PricewaterhouseCoopers LLP is not required to be submitted to a vote of the stockholders, the Board of Directors believes it is appropriate as a matter of policy to request that the stockholders ratify the selection of its independent registered public accounting firm for the fiscal year ending December 31,

2020.2023. If the stockholders fail to ratify the appointment, the Audit Committee of the Board of Directors will consider it as a direction to select other auditors for the subsequent year. Even if the selection is ratified, the Board of Directors or the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Board of Directors or Audit Committee feels that such a change would be in the best interests of the Company and our stockholders.

The Company anticipates that a representative of PricewaterhouseCoopers LLP will be present at the Annual Meeting. Such representative will be given the opportunity to make a statement if he or she desires to do so and is expected to be available to respond to appropriate questions at the meeting.

The following table sets forth the aggregate fees billed to the Company for the fiscal years ended December 31, 20192022 and 20182021 by PricewaterhouseCoopers LLP:

Audit Fees(1) | | | $1,675,000 | | | $1,212,000 |

Audit-Related Fees(2) | | | 56,000 | | | 170,900 |

Tax Fees(3) | | | 120,000 | | | 95,000 |

All Other Fees | | | — | | | — |

Total Fees | | | $1,851,000 | | | $1,477,900 |

(1)

| Audit Fees consisted of fees billed for professional services rendered for the audit of the Company’s consolidated annual financial statements and review of the interim condensed consolidated financial statements included in quarterly reports and services that are normally provided by our independent registered public accountants in connection with statutory and regulatory filings or engagements. |

(2)

| Included fees for professional services rendered in connection with the implementation of a new enterprise resource planning (ERP) system. |

(3)

| Included fees for professional services rendered in connection with tax compliance and permissible tax consulting. |

| | | | | | | |

| | Fiscal Years | |

|---|

| | December 31,

2019 | | December 31,

2018 | |

|---|

Audit Fees(1) | | $ | 1,800,000 | | $ | 1,914,000 | |

Audit-Related Fees(2) | | | 3,000 | | | 540,202 | |

Tax Fees(3) | | | 246,000 | | | 71,000 | |

All Other Fees | | | — | | | — | |

| | | | | | | | |

Total Fees | | $ | 2,049,000 | | $ | 2,525,202 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(1)Audit Fees consisted of fees billed for professional services rendered for the audit of the Company's consolidated annual financial statements and review of the interim condensed consolidated financial statements included in quarterly reports and services that are normally provided by our independent registered public accountants in connection with statutory and regulatory filings or engagements.

(2)Included fees for professional services rendered in connection with potential M&A transactions.

(3)Included fees for professional services rendered in connection with tax compliance and permissible tax consulting.

The Audit Committee has considered whether the provisions of services described in the table above are compatible with maintaining auditor independence. Before the independent auditor is engaged by the Company or its subsidiaries to render audit or non-audit services, the Audit Committee shall pre-approve the engagement. Audit Committee pre-approval of audit and non-audit services will not be required if the engagement for the services is entered into pursuant to pre-approval policies and procedures established by the Audit Committee regarding the Company'sCompany’s engagement of the

Table of Contents

independent auditor, provided the policies and procedures are detailed as to the particular service, the Audit Committee is informed of each service provided and such policies and procedures do not include delegation of the Audit Committee'sCommittee’s responsibilities under the Securities Exchange Act of 1934, as amended, to the Company'sCompany’s management. All of the fees described above under Audit Fees, Audit-Related Fees, Tax Fees and All Other Fees were pre-approved by the Audit Committee pursuant to its pre-approval policies and procedures.

TABLE OF CONTENTS

Approval of this proposal requires the affirmative vote of a majority of the votes cast by holders of shares of ISG common stock represented in person or by proxy at the Annual Meeting. Abstentions will have no effect on the outcome of this proposal because they are not considered

"votes cast"“votes cast” for voting purposes. Under

theapplicable rules

of the New York Stock Exchange, member brokers who hold shares in street name for their customers that are the beneficial owners of those shares have the authority to only vote on certain

"routine"“routine” items in the event that they have not received instructions from beneficial owners. This Proposal No. 2 is considered a

"routine"“routine” item, and accordingly, brokers and other nominees will have discretionary authority to vote on this Proposal No. 2, so that we expect that there will be no broker

non votesnon-votes on this

Proposal.proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR"“FOR” THE ENGAGEMENT OF PRICEWATERHOUSECOOPERS LLP AS THE COMPANY'SCOMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 20202023

Table of ContentsTABLE OF CONTENTS

REPORT OF THE AUDIT COMMITTEE

The directors who serve on the Audit Committee are all

"independent"“independent” in accordance with Nasdaq requirements and the applicable SEC rules and regulations. We have reviewed and discussed with management the

Company'sCompany’s Annual Report on Form 10-K, which includes the

Company'sCompany’s integrated audit of the consolidated financial statements for the year ended December 31,

20192022 and

management'smanagement’s report on internal control over financial reporting using the criteria set forth in the framework in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013).

During

2019,2022, the Audit Committee fulfilled all of its responsibilities under its charter that was effective during

2019.2022. As part of the

Company'sCompany’s governance practices, the Audit Committee reviews its charter on an annual basis and, when appropriate, recommends to the Board of Directors changes to its charter. The Board of Directors adopted changes to the Audit Committee charter in

May 2013.March 2023. The revised Audit Committee charter can be obtained through our website (

https://ir.isg-one.com/corporate-overview/documentswww.isg-one.com).We have discussed with the independent registered public accounting firm, PricewaterhouseCoopers LLP, the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and reviewed the results of the independent registered public accounting

firm'sfirm’s integrated audit of the consolidated financial statements.

We have received and reviewed the written disclosures and the letter from PricewaterhouseCoopers LLP, required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent

accountant'saccountant’s communications with the Audit Committee concerning independence, and have discussed with the

independent registered public accounting firm

theirits independence.

Based on the reviews and discussions referred to above, we recommended to the

Company'sCompany’s Board of Directors that the

Company'sCompany’s Annual Report on Form 10-K for the year ended December 31,

20192022 be filed with the Securities and Exchange Commission.

During

2019,2022, directors Neil G. Budnick, Gerald S. Hobbs, Bruce N. Pfau, Christine Putur, Kalpana Raina and Donald C. Waite III served as members of the Audit Committee.

| | |

| | | SUBMITTED BY THE AUDIT COMMITTEE OF

OF THE BOARD OF DIRECTORS |

|

|

| |

| | | THE AUDIT COMMITTEE

Mr. Neil G. Budnick (Chairman)

Mr. Gerald S. Hobbs

Mr. Bruce N. Pfau

Ms. Christine Putur

Ms. Kalpana Raina

Mr. Donald C. Waite III |

Table of ContentsTABLE OF CONTENTS

NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

We are including in this Proxy Statement a separate resolution asking stockholders to vote to approve, in a non-binding advisory vote, the compensation paid to our Named Executive Officers as disclosed in this Proxy Statement on pages

38-4720-30 pursuant to the rules of the SEC. The language of the resolution is as follows:

RESOLVED, THAT THE COMPENSATION PAID TO THE

COMPANY'SCOMPANY’S NAMED EXECUTIVE OFFICERS, AS DISCLOSED IN THIS PROXY STATEMENT,

PURSUANT TO THE RULES OF THE SECURITIES AND EXCHANGE COMMISSION, INCLUDING THE COMPENSATION TABLES AND ANY RELATED NARRATIVE DISCUSSION, IS HEREBY APPROVED.

This item is commonly referred to as a

"say-on-pay"“say-on-pay” proposal. A large majority of our stockholders—

95%88% of the votes

cast—cast - approved our compensation program as described in our proxy

statementsstatement in

2019.2022.

In considering your vote, you may wish to review the information on the

Company'sCompany’s compensation policies and decisions regarding the Named Executive Officers presented in the section entitled

"Executive Compensation"“Executive Compensation” beginning on page

38,20, as well as the discussion regarding the Compensation Committee beginning on page

10.8.

In particular, stockholders should note the following:

The Company believes management compensation should be competitive with market practices, provide rewards based on the attainment of Company objectives and tightly align management with the interests of stockholders.

•At the discretion of the Compensation Committee, the material elements of the compensation system created for the Company'sCompany’s Named Executive Officers include a mix of base salary, annual performance-based cash incentive awards and long-term equity incentive awards.

•The Company believes that the compensation provided to the Named Executive Officers is competitive with market norms, is predicated on "pay-for-performance"“pay-versus-performance” and is tightly aligned with the interests of the Company'sCompany’s stockholders.

•In particular,

in 2022, the compensation we paid the Named Executive Officers

for 2019 was

in lineconsistent with

ourthe financial

results andperformance of the Company, the progress implementing our long-term growth

strategy that was achieved by our management team duringand the

year.competitive market for talent. In 2022, ISG reported revenue of $286.3 million, operating income of $29.5 million, GAAP EPS $0.39 and adjusted EPS of $0.53, and $43.3 million of EBITDA, all record highs.

Because this vote is advisory and non-binding on the Board of Directors, the Board and the Compensation Committee will review and consider the voting results, as well as other communications from stockholders relating to our compensation practices, and take them into account in future determinations concerning our executive compensation programs.

Approval of this proposal requires the affirmative vote of a majority of the votes cast by holders of shares of ISG common stock represented in person or by proxy and entitled to vote at the Annual Meeting.

Abstentions and broker non-votes will have no effect on the outcome of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR"“FOR” APPROVAL OF THE

COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS.

TABLE OF CONTENTS

Table of Contents

NON-BINDING ADVISORY VOTE ON THE FREQUENCY

OF

AN AMENDMENT TO THEAMENDED AND RESTATED 2007 EQUITY AND INCENTIVE AWARD PLANIntroduction

AtSTOCKHOLDER VOTES ON EXECUTIVE COMPENSATION

In accordance with the

Annual Meeting, stockholders will be askedrequirements of Section 14A of the Exchange Act and the related rules of the SEC, we are including in this Proxy Statement a separate resolution subject to stockholder vote to determine, in a non-binding advisory vote, whether a stockholder vote to approve

an amendmentthe compensation paid to our named executive officers (that is, a vote similar to the

Amended and Restated 2007 Equity and Incentive Award Plan (the "Plan"non-binding advisory vote in Proposal No. 3 on page 15)

primarilyshould occur every one, two or three years. In considering your vote, you may wish to

increasereview with care the

number of shares of common stock available for issuance under the Plan by 5,500,000 shares and take related actions as described below (the "Amendment"). With the addition of shares available for issuance pursuant to the Amendment, the Plan is expected to continue to benefit ISG by helping us:•Recruit and retain key employees, directors or other independent contractors serving ISG and its affiliates;

•Motivate such persons to exert their best efforts on behalf of ISG and its affiliates by providing incentives in the form of equity awards and cash incentive awards; and

•Provide to such persons an added interest in the welfare of ISG as a result of their proprietary interest in ISG's success.

The Board and the Committee believe that awards linked to common stock and awards with terms tied to our performance provide incentives for the achievement of important performance objectives and promote the long-term success of ISG. Therefore, they view the Amendment and the Plan as a key element of our overall compensation program.

One other change implemented by the Amendment will be to extend the termination date for the making of grants from April 27, 2022 until the fifth anniversary of stockholder approval of this Proposal.

The Board believes that the Plan promotes the interests of stockholders and is consistent with principles of effective corporate governance, among other reasons, because:

•Limits on Awards. The Plan limits the number of stock options, stock appreciation rights and performance-based awards that may be granted to any person in any calendar year. It also limits the amount that may be payable to any person in any calendar year under cash awards made pursuant to the Plan and contains a separate limit that applies to awards granted to our non-employee directors.

•No Discounted Stock Options or SARs. All stock option and stock appreciation rights ("SARs") under the Plan must have an exercise or base price that is not less than the fair market value of an underlying share of our common stockinformation on the date of grant (except whenCompany’s compensation policies and decisions regarding the awards are substituted for certain in-the-money awards).

•No Repricing. The Plan prohibits any repricing of stock options or SARs without stockholder approval, other than adjustments tonamed executive officers presented in Executive Compensation beginning on page 20, as well as the awards in connection with a corporate transaction affecting the Company.

•Dividends. Under the Amendment, dividends and dividend equivalents will be subject to vesting terms at least as stringent as those that apply to the underlying award.

•No Tax Gross-Ups. The Plan does not provide for tax gross-ups with respect to awards.

Amendment

Under the Plan, as of March 4, 2020, 774,745 shares remain available for new grants, with each share delivered under the Plan counting as one share against the share pool. The proposed Amendment would amend Section 3 of the Plan to increase the number of shares issuable under the

Table of Contents

Plan by 5,500,000 so that the total number of shares available for grants is 6,274,745 and the total numbers of share subject to outstanding awards and to be available for future awards is 11,872,839.

On March 10, 2020, our Board, upon recommendation ofdiscussion regarding the Compensation Committee adopted the Amendment, subject to approval by our stockholders. If our stockholders approve the Amendment, it will become effective as of the date of such stockholder approval. If stockholders decline to approve the Amendment, no additional shares will become available for awards under the Plan, but awards may continue to be granted under the current terms of the Plan, to the extent of available shares, and otherwise under other authority of the Board of Directors and the Compensation Committee.

The additional shares available for issuance under the Plan are intended to cover equity awards over the next several fiscal years. The Company frequently uses equity awards in lieu of cash to reward for annual performance.

Except as described above, the Company is not seeking to make any other material changes to the terms of the Plan at this time. A copy of the Plan, reflecting changes related to the Amendment, is attached as Appendix A to this Proxy Statement, and below is a summary of the material terms of the Plan (which is subject in all cases to the actual terms of the Plan).

Types of Plan Awards

The Plan authorizes a broad range of award types, including:

•stock options, which may be incentive stock options providing favorable tax treatment to employees under Section 422 of the Internal Revenue Code or non-qualified stock options (i.e., options not qualifying for such favorable tax treatment);

•stock appreciation rights ("SARs");

•restricted stock, an award of actual shares subject to a risk of forfeiture and restrictions on transfer;

•restricted stock units ("RSUs"), a contractual commitment to deliver shares at a future date, which may or may not be subject to a risk of forfeiture;

•other awards based on ISG common stock;

•performance-based awards; and

•incentive awards, which are cash-denominated awards earnable by achievement of performance goals.

Shares Reserved For Equity Awards

Information on the number of shares available under the Plan, our only equity award plan, and under our Amended and Restated 2007 Employee Stock Purchase Plan, and unissued shares deliverable under outstanding RSUs as of the end of the last fiscal year is presented beginning on page 29 under8.

This Annual Meeting will provide stockholders the

caption "Equity Compensation Plan Information Table." Basedopportunity to express their views on the outstanding equity awards underCompany’s compensation system through a non-binding advisory vote. Moreover, stockholders will also have the Planopportunity at March 4, 2020, and assuming stockholdersthis Annual Meeting to hold a non-binding advisory vote on the frequency of subsequent advisory votes.

The Board has determined that an advisory vote to approve

executive compensation that occurs every year is the

Amendment, the total number of shares subject to outstanding awards and to

Table of Contents

be available for future awards under the Plan (which would be our only continuing equity award plan) would be as follows:

| | | | |

Shares subject to outstanding awards*

| | | 5,598,094 | |

Shares remaining available under the Plan

| | | 774,745 | |

Shares to be added if stockholders approve the Amendment

| | | 5,500,000 | |

| | | | |